After a bruising week in both crypto and traditional markets, today’s spotlight was squarely on the Trump–Musk feud, which sent shockwaves through Bitcoin (BTC) and politically-linked tokens like TRUMP.

Yet beneath the headlines, altcoins showed remarkable strength. AI-focused FLOCK rallied post-KuCoin listing, while IOST soared on fresh institutional backing for its tokenized asset push. HUMA attracted yield-hunters with its 2.0 relaunch, and TRUMP suffered from cascading macro fears. With equities posting gains after solid U.S. jobs data and Germany navigating a diplomatic win, both crypto and global investors juggled volatility with selective risk appetite. These five tokens captured the mood across a fractured but opportunistic market today.

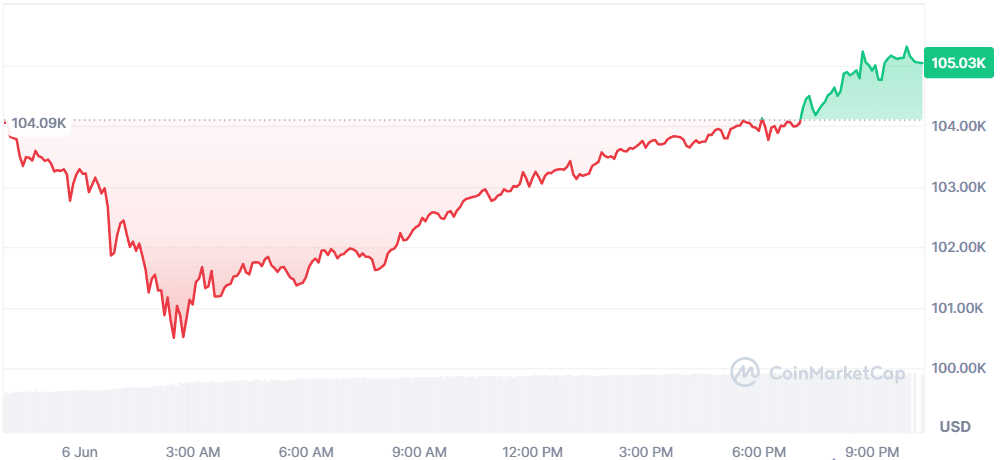

Bitcoin (BTC)

Price Change (24H): +1.34% Current Price: $104,996.70

What happened today

Bitcoin remained highly volatile, initially falling to $100K due to heightened market tension sparked by the Trump–Musk feud, but quickly rebounded as positive institutional news provided a floor. JPMorgan announced it would accept Bitcoin ETF shares as collateral for global loans, signaling greater institutional acceptance and deepening liquidity. Meanwhile, South Korea’s new pro-Bitcoin policy also bolstered sentiment. However, legal uncertainty looms in the EU with new EDPB guidelines that could render Bitcoin non-compliant with GDPR, raising questions about its future viability in Europe. Separately, Willy Woo warned users of Strike about hidden Bitcoin custody risks, spotlighting ongoing concerns about asset rehypothecation in crypto platforms.

Market Cap: $2.08T 24-Hour Trading Volume: $62.65B Circulating Supply: 19.87M BTC

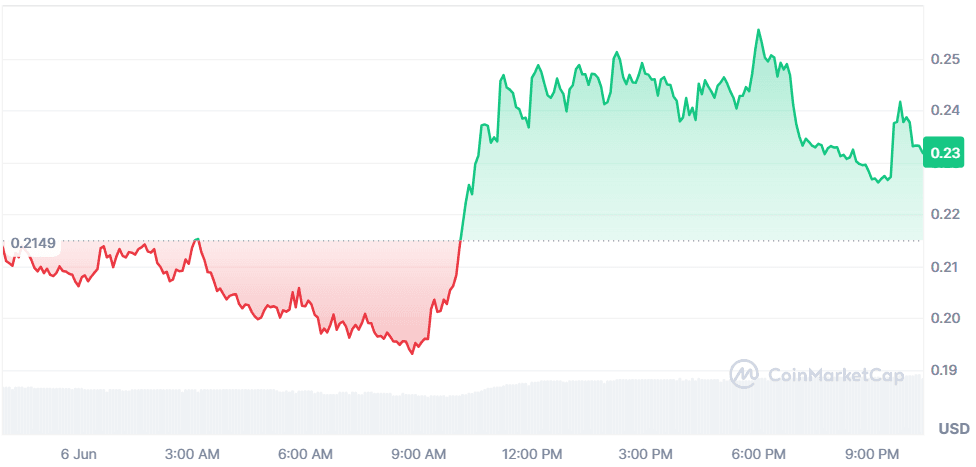

FLock.io (FLOCK)

Price Change (24H): +9.09% Current Price: $0.2317

What happened today

FLock.io surged following its high-profile listing on KuCoin, one of the leading global crypto exchanges. Trading in the FLOCK/USDT pair began today, fueling significant buying interest. The project, which enables privacy-preserving AI model training on blockchain, is riding strong narratives in both the AI and Web3 sectors. The listing also opens the door to more liquidity and visibility for the token. KuCoin further amplified this launch by supporting trading bots for FLOCK/USDT, helping to attract active traders and algorithmic capital.

Market Cap: $43.35M 24-Hour Trading Volume: $71.38M Circulating Supply: 187.08M FLOCK

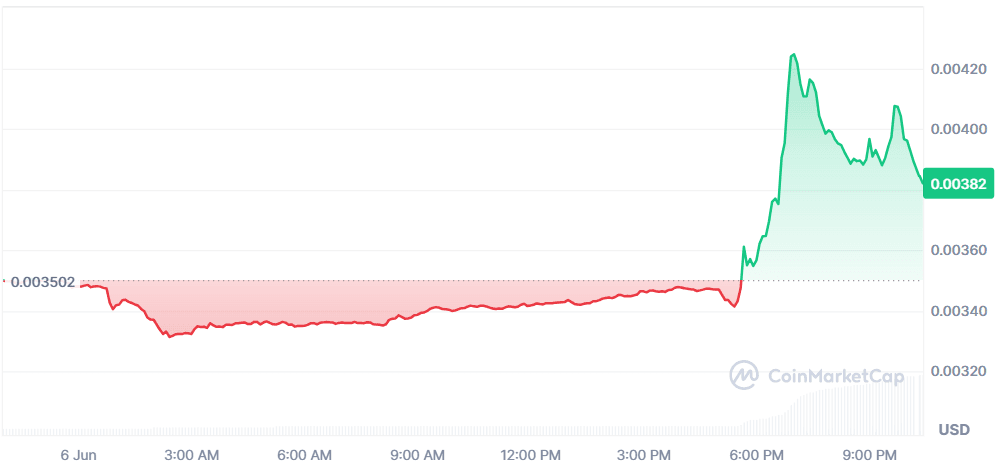

IOST (IOST)

Price Change (24H): +9.35% Current Price: $0.003820

What happened today

IOST rallied after raising $21M in a strategic round aimed at scaling its tokenized real-world asset (RWA) infrastructure. The funding, led by DWF Labs and other institutional players, will be used to expand IOST’s compliant asset issuance platforms, with initial focus on Japan and Asia-Pacific markets. As tokenization narratives gain traction across TradFi, IOST’s unique regulatory approvals (e.g., Japan’s JVCEA) position it well for institutional adoption. The news reinforced investor confidence in IOST’s RWA strategy and Layer 1 capabilities, fueling today’s sharp price move.

Market Cap: $97.83M 24-Hour Trading Volume: $72.74M Circulating Supply: 25.61B IOST

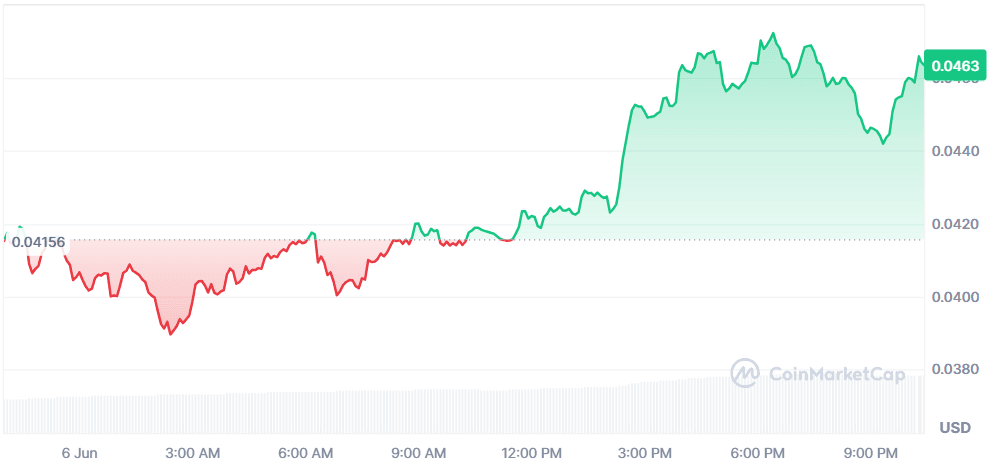

Huma Finance (HUMA)

Price Change (24H): +10.63% Current Price: $0.04636

What happened today

Huma Finance gained momentum as it reopened deposits for its Huma 2.0 program, offering early access and yield incentives to HUMA stakers. The reopening triggered renewed buying from loyal holders and yield farmers. In parallel, Huma publicly celebrated its ongoing partnership with Circle, as the latter debuted with soaring IPO prices from crypto fans. The convergence of real yield opportunities and strong partner signaling helped drive today’s bullish sentiment around the token.

Market Cap: $80.36M 24-Hour Trading Volume: $316.15M Circulating Supply: 1.73B HUMA

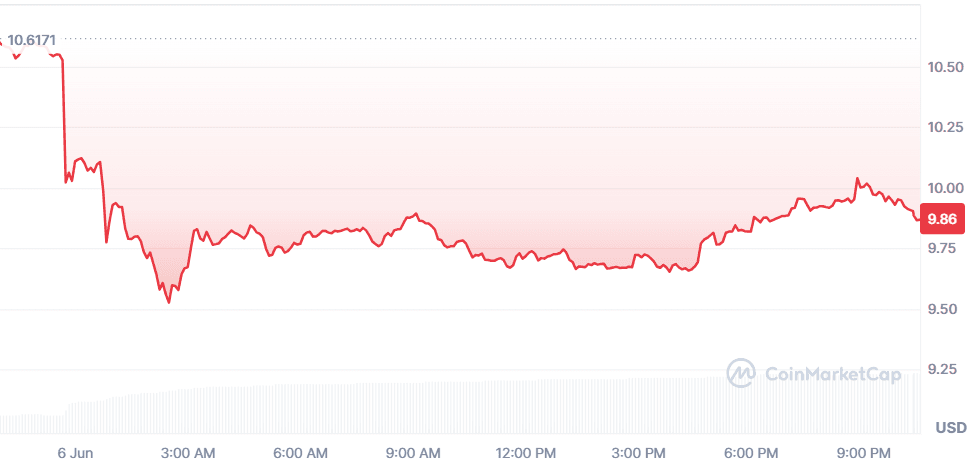

OFFICIAL TRUMP (TRUMP)

Price Change (24H): -6.27% Current Price: $9.86

What happened today

The TRUMP token faced sharp selling pressure amid escalating public conflict between Donald Trump and Elon Musk, which spilled over into crypto sentiment more broadly. The feud, centered around the "One Big Beautiful Bill" and personal attacks, triggered uncertainty in politically-linked assets. Additionally, BTC’s drop toward $100K during the drama added macro pressure, dragging TRUMP down further. The broader market viewed the feud as a destabilizing event, causing caution among speculative token holders.

Market Cap: $1.97B 24-Hour Trading Volume: $958.6M Circulating Supply: 199.99M TRUMP

Global Market Snapshot

Global markets navigated a volatile day shaped by geopolitical theatrics and solid macro data. The Musk–Trump feud dominated headlines, temporarily driving BTC below $100K and triggering speculative unwinds across tech-linked and meme assets. Yet, positive U.S. jobs data provided a stabilizing force: the Dow rallied 391 points and the S&P 500 reclaimed the 6,000 level on expectations of continued economic resilience. German Chancellor Merz quietly scored a diplomatic win in Washington, reinforcing EU–U.S. ties amid broader tariff and defense debates. Meanwhile, Trump’s public calls for an aggressive Fed rate cut reflect the continued tension between political and monetary policy paths. As crypto markets absorbed the Trump–Musk drama and institutional Bitcoin news, equities closed the week with cautious optimism, balancing strong labor data against evolving macro risks.

Closing Thoughts

Investor sentiment remains highly polarized across asset classes. In crypto, speculative sectors like AI (FLOCK) and RWA platforms (IOST) are clearly attracting fresh participation, driven by narratives of future growth and regulatory positioning. Meanwhile, politically-linked tokens such as TRUMP are proving fragile under real-world macro and media pressure. BTC’s resilience post-$100K dip shows that institutional flows remain a stabilizing force, but headline risks remain potent.

In global markets, a classic “risk-on” rally is underway in equities after a strong U.S. jobs report, even as Trump’s public calls for aggressive Fed cuts signal rising political interference risks. This macro tailwind is temporarily supporting crypto’s rebound as well, with traders quick to rotate into AI, yield, and infrastructure plays. The next phase hinges on whether BTC can reclaim technical leadership, and whether altcoins sustain real flow or revert to speculative chop.